Top Factors Driving Growth in the India Motorcycle Tires Market

.webp)

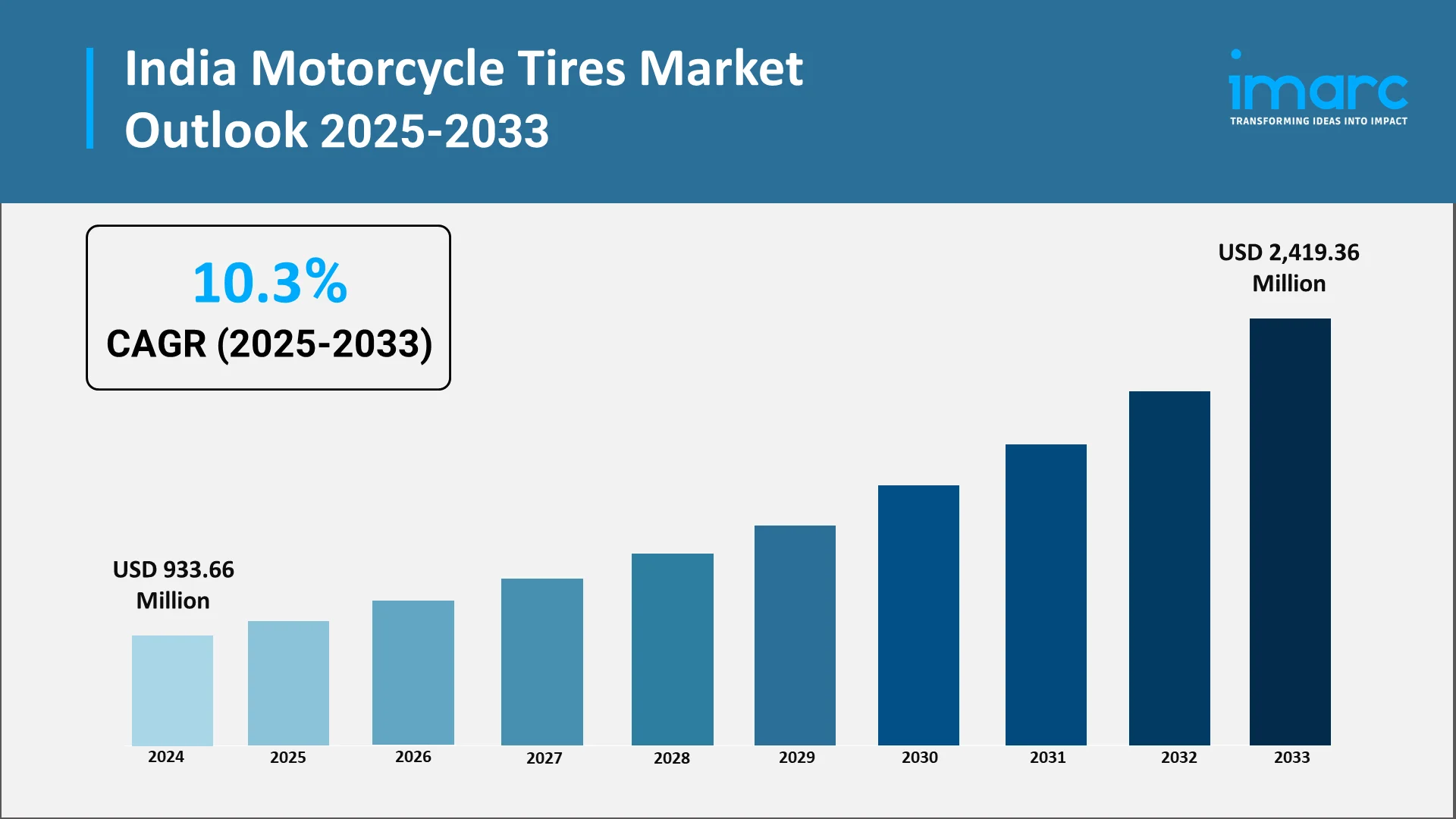

The continues to evolve in response to changing mobility preferences, rising urbanization, and the growing significance of two-wheelers as essential transportation assets for millions of riders. As per sources, the India motorcycle tires market size reached USD 933.66 Million in 2024. The market is projected to reach USD 2,419.36 Million by 2033, exhibiting a growth rate (CAGR) of 10.3% during 2025-2033. Furthermore, tire manufacturers, retailers, and aftermarket service providers are reshaping their strategies to meet the dynamic expectations of commuters, delivery professionals, performance bike owners, and digital-first consumers. This transformation is driven by a wide set of factors that interact with each other, ranging from shifts in daily mobility habits to advancements in tire technology and the rising penetration of online retail platforms. As a result, the market has moved beyond traditional replacement cycles and now encompasses a broader ecosystem of innovation, convenience, and personalization.

Two-wheelers remain deeply integrated into India’s mobility landscape, serving as daily commuting vehicles, short-distance connectors, and essential business tools for delivery and logistics operations. Tires, as the primary interface between the vehicle and the road, require continuous replacement, performance optimization, and quality enhancement. The market’s growth is therefore closely tied to the rising expectations of consumers who demand durability, safety, grip, reliability, and convenience from every replacement cycle. In this context, the leading factors shaping the current and future trajectory of the India motorcycle tires market can be understood through the lens of demand drivers, technological innovations, online distribution channels, and the competitive environment.

Explore in-depth findings for this market, Request Sample

Rising Two-Wheeler Sales Increasing Tire Replacement Demand:

- The most prominent driver in the market is the Rising two-wheeler sales increasing tire replacement demand, which directly shapes aftermarket consumption patterns. India’s two-wheeler culture is embedded in everyday life, with motorcycles and scooters serving as indispensable mobility tools for personal, professional, and commercial use. The expansive presence of two-wheelers naturally leads to consistent usage of tires, which undergo wear and tear through daily commuting, rough surfaces, changing weather conditions, and frequent braking in stop-and-go traffic. In December 2024, Hero MotoCorp launched the updated Vida V2 electric scooter range in India, featuring 12-inch MRF Zapper N tubeless tyres across Lite, Plus, and Pro variants. Moreover, this high-usage environment ensures that the aftermarket for motorcycle tires remains continuously active and resilient.

- One of the defining contributors to this demand is the rapid scaling of India’s last-mile delivery economy. Food delivery services, e-commerce logistics, hyperlocal transportation networks, and courier businesses rely heavily on motorcycles to complete fast, cost-effective, and agile deliveries. These motorcycles are used throughout the day, often across extended distances and challenging routes, leading to accelerated tire wear. As delivery fleets expand, the rate at which tires need replacement increases proportionally, generating strong and consistent aftermarket opportunities.

- The growth in personal commuting also plays a crucial role, as more individuals rely on motorcycles to navigate traffic congestion, minimize travel time, and manage daily routines. Riders in both urban and semi-urban environments prioritize reliability, smooth riding comfort, and safety—making timely tire replacement essential. As commuting intensifies, riders increasingly recognize the value of high-quality tires that offer long life, strong grip, and stability on diverse road surfaces.

- This interplay between lifestyle needs, commercial logistics, and high-frequency usage ensures that the India motorcycle tires market continues to benefit from strong replacement demand, even as consumer preferences evolve and new mobility trends emerge.

Market Size & Growth Opportunity:

- Another major factor driving expansion is the Market Size & Growth Opportunity, underpinned by the country’s vast and continuously growing base of two-wheelers. India’s installed motorcycle population is one of the largest globally, creating a naturally recurring cycle of tire purchases. Every motorcycle—regardless of age, model, or engine capacity—requires periodic tire replacement, making the aftermarket segment a highly stable and dependable revenue generator for manufacturers and retailers.

- This extensive installed base is distributed across diverse geographies, from densely populated metro cities to remote villages. Such widespread adoption ensures that the demand for replacement tires remains unaffected by regional economic fluctuations. Even older motorcycles and low-cost commuter bikes, which dominate many markets, require routine tire servicing, making the sector resilient across income levels and demographic groups.

- The sheer volume of motorcycles in operation also creates a multiplier effect for growth opportunities. Retailers benefit from consistently high footfall, while tire brands can introduce different product ranges catering to various segments—commuter bikes, scooters, premium motorcycles, off-road bikes, and performance vehicles. Manufacturers also explore partnerships with mechanics, workshops, and fleet operators to maximize access and distribution.

- Moreover, the presence of a massive motorcycle population encourages tire companies to innovate with better compounds, optimized tread patterns, and advanced materials that increase longevity and reliability. These innovations enhance consumer trust and elevate market potential, solidifying the role of the extensive motorcycle base as a core pillar of sustained growth in the India motorcycle tires market. In January 2024, CEAT launched its premium Sportrad and Crossrad steel radial tyres in India, designed for high-performance motorcycles, offering advanced grip, stability, and multi-terrain capability for enthusiasts.

Shift Toward Tubeless & Premium Radial Tires:

- A technological and consumer-driven shift is reshaping product preferences in the market, particularly through the Shift toward tubeless & premium radial tires. As motorcycle buyers become more performance-conscious and design-oriented, demand is rising for tires that offer enhanced safety, control, road grip, and responsiveness. In October 2024, Reise Moto introduced its TraceRad steel radial motorcycle tyres in India, featuring zero-degree steel belt construction, enhanced grip, improved high-speed stability, and a six-year warranty for riders.

- Tubeless tires have emerged as a preferred choice among modern riders due to their superior ability to retain air pressure, resist sudden puncture deflation, and enhance overall safety. These tires are especially valued in urban environments where unexpected road debris, potholes, and sharp objects can lead to frequent punctures. The convenience of repairing a tubeless tire also appeals to riders who prioritize minimal downtime.

- In parallel, radial tires are gaining significant traction, particularly among youth and performance-oriented motorcycle owners. Performance bikes, sports models, and premium motorcycles benefit from radial tires because they offer better heat dissipation, advanced cornering stability, smoother handling, and improved contact patch behavior. Young riders, who increasingly prioritize thrill, style, and technical refinement, recognize the importance of high-grip tires for both safety and performance enhancement.

- This trend also reflects the widespread influence of motorsports culture, motorcycle touring communities, and enthusiast groups, all encouraging riders to invest in superior tire technology. Manufacturers are responding actively by expanding their portfolios with premium compounds, advanced tread designs, and application-specific tire models tailored for sport riding, long-distance touring, or daily commuting. In November 2025, Eurogrip, part of TVS Srichakra Ltd, launched its new Trailhound Wild and Bee Wild adventure and scooter tyre range at EICMA 2025 in Milan, enhancing global two-wheeler offerings.

- The shift toward tubeless and radial options marks a significant step in India’s motorcycle tire evolution, signaling a mature consumer base that values technological advancements and premium riding experiences.

Growth of Online Tire Retail and Doorstep Replacement:

- Digital transformation has become a powerful market enabler, driving enthusiasm for e-commerce platforms and online service ecosystems. The Growth of online tire retail and doorstep replacement is fueling a new wave of convenience and efficiency in the India motorcycle tires market, reshaping how consumers purchase and replace tires.

- Riders now increasingly rely on digital platforms to compare tire models, read reviews, understand features, and make informed purchase decisions. Online retail eliminates traditional barriers such as limited inventory, geographical constraints, and inconsistent pricing. Instead, buyers gain access to extensive catalogs, personalized suggestions, transparent pricing, and quick delivery.

- One of the most notable developments is the rise of doorstep tire replacement services, allowing riders to book installation sessions directly through mobile apps or websites. These services send trained technicians equipped with portable machines to the customer’s location, making tire replacement quick, clean, and hassle-free. This model resonates strongly with urban commuters, busy executives, and delivery riders who value minimal downtime and on-demand convenience. In May 2025, TyresNmore completed over 3 lakh doorstep two-wheeler tyre installations across India, offering fast, convenient, and fully equipped mobile garage services that redefine motorcycle tyre replacement for riders.

- Digital engagement also supports manufacturers and retailers by offering real-time insights into consumer preferences, enabling better inventory management and targeted marketing. Subscription-based maintenance packages, online warranties, and digital service records further strengthen the digital ecosystem surrounding motorcycle tire replacement.

- This growing preference for online purchasing and doorstep services reflects India’s broader digital evolution, positioning convenience and transparency at the center of tire-buying behavior.

Top Companies in India Motorcycle Tires Market:

- The industry is strongly shaped by the presence of well-established brands and a competitive ecosystem featuring both domestic and global players. The Top Companies in India Motorcycle Tires Market, including MRF, CEAT, Apollo, TVS Eurogrip, JK Tyre, Michelin, and Maxxis, contribute significantly to product innovation, distribution strength, brand trust, and consumer awareness.

- These companies maintain extensive dealership networks, OEM partnerships, and aftermarket influence, enabling them to meet consumer expectations across India’s diverse regions. Their product ranges include commuter tires, scooter tires, premium radial models, grip-enhanced sport tires, off-road patterns, and long-life durability tires. With continuous improvement in tread engineering, material science, and compound technology, these brands actively elevate performance standards for both budget-conscious and premium consumer segments.

- Innovation also remains central to their strategies. Many leading brands invest heavily in R&D to develop tires that deliver smoother rides, longer life, enhanced stability, and superior braking efficiency across various terrains. Additionally, these companies are expanding their footprint in the online retail ecosystem, partnering with e-commerce platforms and deploying mobile service fleets to enhance consumer convenience. Together, these leading tire manufacturers shape the market’s direction, set quality benchmarks, and play a pivotal role in meeting India’s evolving mobility needs.

Choose IMARC Group as We Offer Unmatched Expertise and Core Services:

- Data-Driven Market Research: Access high-quality, data-rich reports that explore core elements of the India motorcycle tires market, including rising demand drivers, evolving consumer behaviors, and technological upgrades in tread, compound, and radial tire engineering.

- Strategic Growth Forecasting: Leverage forward-looking analyses to anticipate shifts in tire preferences, adoption of tubeless and radial technologies, patterns in aftermarket replacement cycles, and emerging online retail channels that are transforming the tire distribution landscape.

- Competitive Benchmarking: Evaluate the competitive dynamics shaping the motorcycle tire industry, reviewing product portfolios, innovation pipelines, and positioning strategies of leading companies such as those offering commuter, performance, and premium tire categories.

- Policy and Infrastructure Advisory: Stay updated on evolving regulatory requirements, road safety initiatives, sustainability considerations, and infrastructure developments that influence tire manufacturing and aftermarket demand across regions.

- Custom Reports and Consulting: Receive tailored intelligence aligned with your organization’s goals, whether it involves expanding distribution networks, launching new tire variants, or analyzing opportunities in India’s rapidly evolving two-wheeler aftermarket.

At IMARC Group, our purpose is to provide clarity, confidence, and strategic direction to businesses operating in the motorcycle tires domain. By combining technical insight, market expertise, and forward-thinking perspectives, we help organizations navigate the complexities of India’s mobility ecosystem and unlock long-term growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)